Egyptian American Bank

Money Transfer

Mobile banking offers flexibility and convenience to bank consumers, who wish to carry out financial transactions outside of traditional bank branch hours and from any location. In a 2017 survey, 77 percent of the respondents started using mobile banking apps to verify their account balance. However, one of the main concerns of those who don't use mobile banking services is the security issue.

Egyptian American Bank has been watching this trend in mobile banking, along with the concerns of how secure these applications are. Research shows that 69.3 percent of Millennials used mobile banking whereas, only 24 percent of Baby boomers used it.

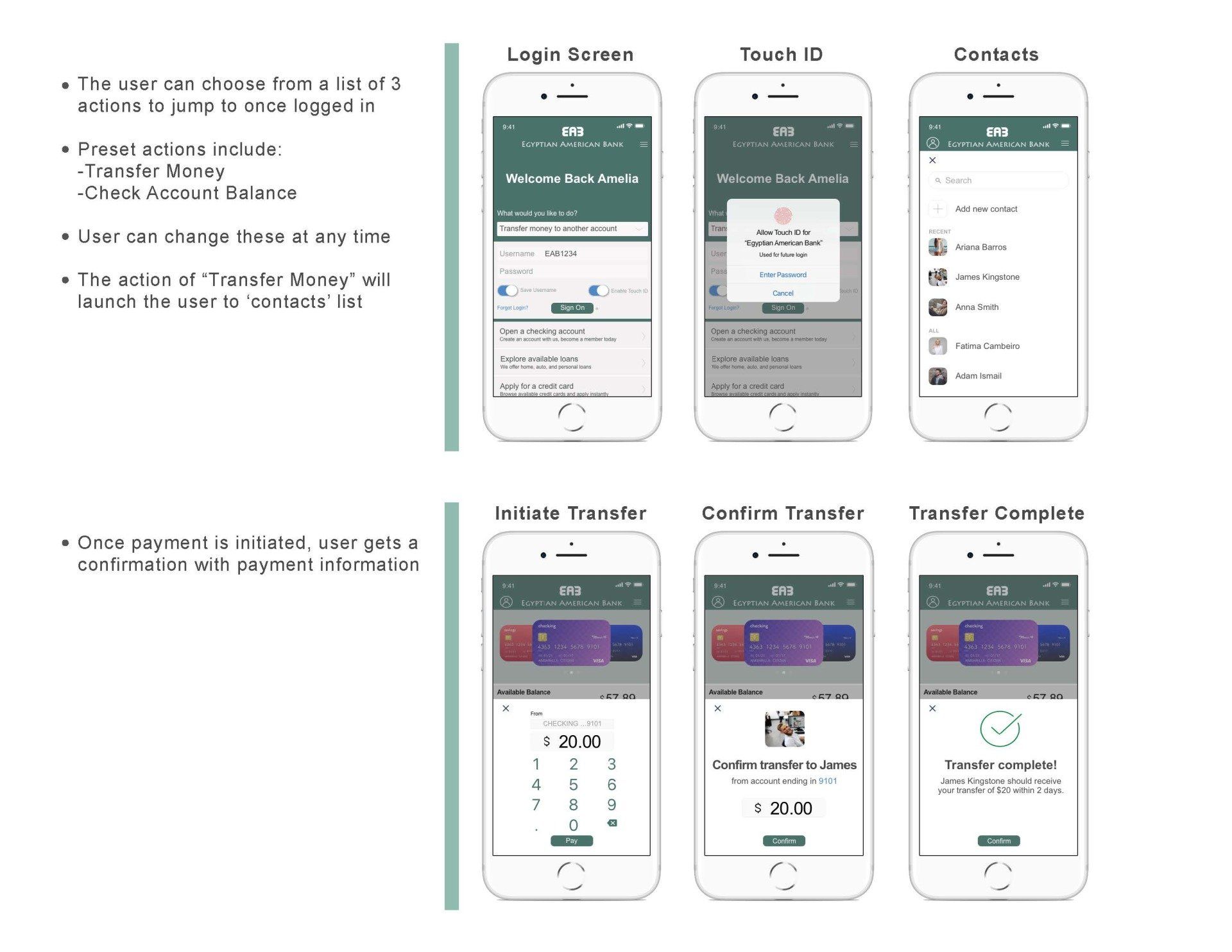

EAB wanted to combine the ease of mobile banking with the trend of sending money via applications.

Inspiration

With the increase in users preferring mobile methods, banks are trying to gain users back by providing an all-in-one application.

Zelle has been prominent in this effort, partnering with major banks such as Wells Fargo, Bank of America, and Chase. So far, Zelle has already processed more than 320 million transactions valued at $94bn total. Egyptian American Bank has been watching this trend, and decided to lead the effort for their own users through this application.

We found that majority of our users used the application for simple banking needs. Our goal was to eliminate their use of multiple applications (i.e Venmo, Cash App), and provide the user one central place to handle all their transactions. Our approach was to merge banking made simple with the personability of applications such as Venmo to give the user the ultimate all-in-one experience.

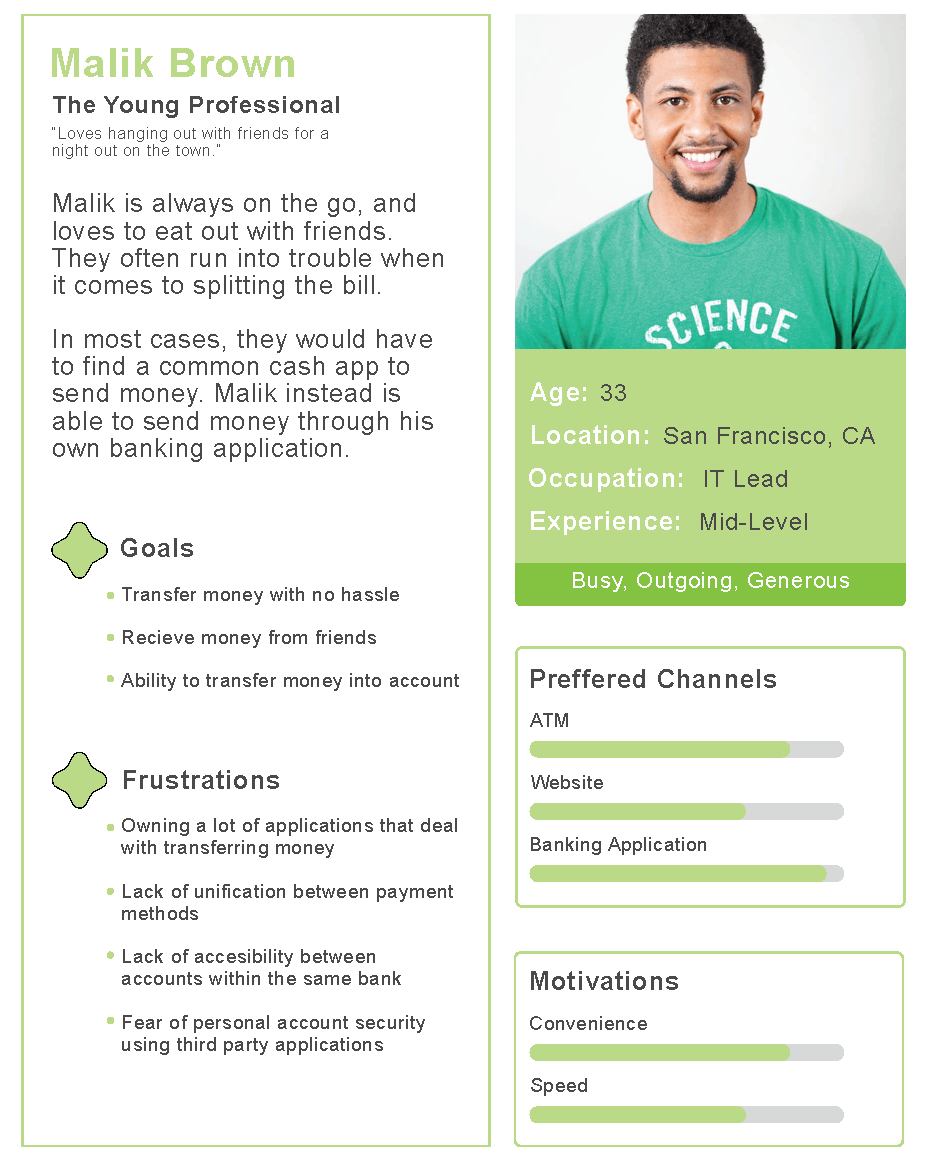

Meet Malik

When developing the persona, we wanted to focus on young individuals who are actively out with friends. Allowing them to have some instances where a bill must be split.

Our research found that majority of restaurants have a limit to how many cards they can use in splitting the bill, regardless of the party size.

So how do we try and limit the frustration of our users? What will they need out of a banking app that 3rd party apps do not provide? We dove into this issue while designing our banking application, in order to provide a 'one stop shop' for our users.